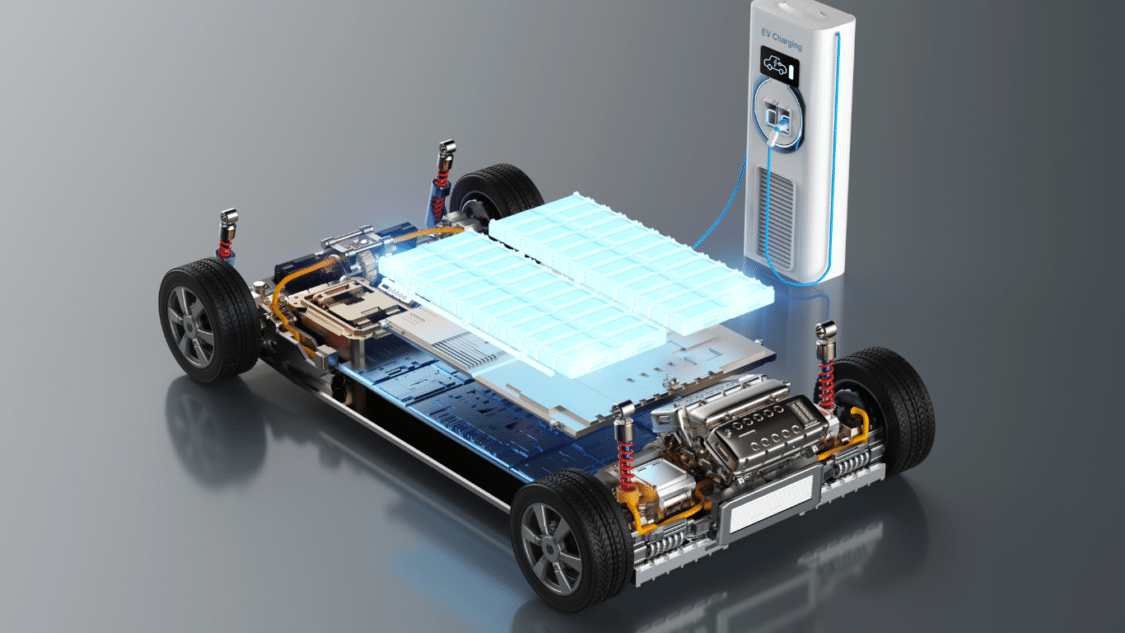

Investing in EV battery stocks can be a smart move for several reasons. Firstly, the demand for EV batteries is expected to skyrocket in the coming years as the EV market continues to expand. This increased demand for batteries will directly benefit the companies producing and supplying these batteries, making their stocks an attractive investment option.

Secondly, EV battery technology constantly evolves, with companies investing heavily in research and development to improve battery efficiency and performance. By investing in EV battery stocks, you can capitalize on the advancements in battery technology and potentially reap significant returns.

The Rise of EV Battery Stocks

The transition to electric vehicles is well on the rise, with major automakers investing heavily in EV production. The industry pioneer Tesla has been at the forefront of the EV revolution, achieving record sales and dominating the market. Automakers like Ford, General Motors, and Volkswagen are ramping up their EV production capabilities to meet the growing consumer demand.

As the production of EV cars increases, so does the demand for EV batteries. Major battery producers are investing heavily to meet this rising demand, while battery technology start-ups are introducing new types of energy storage systems that have the potential to revolutionize the industry.

Top EV battery stocks to invest in 2023 – 2024

As we look ahead, several EV battery stocks to invest in 2023-2024 stand out as promising investment options.

One such stock is XYZ Corporation, a leading EV battery market player known for its innovative and high-performance batteries. The company has a strong financial position and a robust pipeline of new battery technologies, making it an attractive choice for investors.

Another promising option is ABC Inc., a well-established company with a proven track record in the EV battery industry. ABC Inc. has a diversified product portfolio and a significant presence in domestic and international markets. With its focus on sustainable and energy-efficient solutions, ABC Inc. is well-positioned to capitalize on the growing demand for EV batteries.

Electric car companies’ stock options

In addition to investing in pure-play best EV stocks, another avenue to consider is investing in electric car companies stocks with a stake in the EV battery market. These companies benefit from the rising demand for EVs and have the advantage of vertical integration by producing their batteries.

Let’s discover some of the electric car companies stock options.

- BYD (BYDD.F)

BYD is a vertically integrated manufacturer of EVs and components, including batteries. The Chinese company is one of the world’s most valuable automakers and has established itself as a leading player in the EV market. BYD sells a range of hybrid and battery-powered cars, buses, trucks, and monorails. It also builds its own batteries, semiconductors, and other components used in its EVs.

One of the key factors that sets BYD apart is its partnership with Warren Buffett. Berkshire Hathaway, led by Warren Buffett, first invested in BYD in 2008 and remains a major shareholder. This partnership speaks to the company’s credibility and long-term potential in the EV market.

2. Albemarle (ALB)

Albemarle is one of the world’s top lithium producers, a key ingredient in most EV batteries. The company has recently narrowed its focus on lithium to meet the surging demand for battery-grade lithium. Albemarle is developing several lithium projects in Chile, Australia, and China to increase its production capacity.

As the demand for EV batteries rises, Albemarle is well-positioned to benefit from this trend. The company’s revenue grew 120% in 2022, with adjusted EBITDA climbing 299%. Albemarle expects further revenue growth in 2023 and is investing in increasing its production capacity to meet the growing demand for lithium.

3. Panasonic (PCRFY)

Panasonic is a Japanese conglomerate and a major supplier of EV batteries to Tesla. The two companies have had a long-standing partnership, with Panasonic producing batteries for Tesla’s electric vehicles. Panasonic co-located its North American battery production facility in Nevada with Tesla’s Gigafactory 1, allowing efficient collaboration between the two companies.

Panasonic is also expanding its battery production capacity in Japan and is exploring the possibility of building additional factories in the U.S. The company has established itself as a leading EV battery supplier and will likely remain a key player.

4. QuantumScape (QS)

QuantumScape is an early-stage company that is developing solid-state battery technology. The EV industry is highly interested in solid-state batteries due to their potential to increase the range of electric vehicles and allow for faster recharging. This innovation could be a game-changer. QuantumScape is currently testing its battery technology at scale and expects to start commercial battery production in the coming years.

Investing in QuantumScape comes with a degree of risk, as the company is spending heavily on research and development. However, if its technology proves successful, QuantumScape could become a major player in the EV battery market with significant growth potential.

5. Microvast (MVST)

Microvast designs, develops, and manufactures lithium-ion battery solutions. The company went public in 2021 through a merger with a particular purpose acquisition company (SPAC). Microvast batteries are used in a variety of applications, including electric vehicles.

The company is focused on expanding its battery production capacity and developing new battery solutions to tap into the growing EV market. In 2022, Microvast’s revenue growth shows that they have the potential to take advantage of the rising demand for electric vehicle batteries.

6. FREYR Battery (FREY)

FREYR is an early-stage development company that is building battery factories to become one of Europe’s top battery companies for EVs and electric grid storage systems. The company went public through a SPAC merger in 2021 and is focused on securing battery production to meet the rising demand for EV batteries.

While FREYR is still in its early development stages, its long-term growth potential in the EV battery market is promising. With the increasing demand for EVs, FREYR aims to establish itself as a key player in the battery industry.

7. LG Energy Solution

LG Energy Solution is a significant and well-known battery manufacturer worldwide. They are a South Korean-based company providing lithium-ion batteries for various purposes, such as electric vehicles, consumer electronics, energy storage systems, etc.

LG Energy Solution is also one of the significant battery suppliers to automakers worldwide. They partner with companies like General Motors and Hyundai and emphasise improving energy density and durability.

8. Samsung SDI

Samsung SDI is a division of the Samsung Group. They are one the leading battery manufacturers globally. The company specialises in manufacturing lithium-ion batteries for electric vehicles and other applications such as consumer electronics and energy storage systems. Samsung SDI’s batteries are highly sought after due to their exceptional energy density and reliability and are utilised by several automakers.

9. CATL

CATL is a Chinese battery manufacturer and one of the biggest producers of lithium-ion batteries for EV cars. They provide batteries to automakers worldwide, including BMW, Volkswagen, and more.

CATL has significantly emphasised research and development to enhance battery performance and safety.

10. SK Innovation

SK Innovation is a South Korean-based company producing batteries for electric vehicles.

The company has growing plans for battery production in the United States. Additionally, they are focusing on improving energy density and charging speed.

11. Envision AESC

Envision AESC is a battery manufacturer that used to be a subsidiary of Nissan. Their primary focus is on producing lithium-ion batteries used in electric vehicles, and they have supplied these batteries for Nissan’s electric cars. Envision AESC aims to contribute to the growth of electric mobility by providing top-notch battery solutions.

12. A123 Systems

A123 Systems is an American company specialising in advanced lithium-ion battery systems.

They supply battery solutions for EV cars, hybrid vehicles, and energy storage applications. They put a strong emphasis on high power and high energy density.

Several of the noteworthy EV battery stocks manufacturers mentioned earlier are publicly traded companies, offering traders and investors the opportunity to invest in their growth and innovation. LG Energy Solution and Panasonic Corporation are both ev battery stocks available for trading on the OTC market in the U.S. LG Energy Solution’s ticker symbol is LGEAF, while Panasonic Corporation’s symbol is PCRFY. BYD Company Limited, a well-known Chinese EV manufacturer and battery producer, has tickers like BYDDF on the U.S. OTC market and 1211 on the Hong Kong Stock Exchange. Regarding South Korean battery producers, SK Innovation can be found on the Korea Exchange with the ticker 096770.

Strategies for profitable investments in EV battery stocks

Investing in EV battery stocks requires careful consideration and a well-defined strategy. Here are a few strategies to maximize your chances of profitable investments:

- Diversify your portfolio – Investing in various EV battery stocks and electric car stocks can spread your risk and increase your chances of capturing the upside potential of this growing industry.

- Stay informed – Stay updated with the latest developments in the EV industry, including advancements in battery technology, government policies, and market trends. This will help you in making informed investment decisions and identifying emerging opportunities.

- Long-term perspective – The EV industry is still in its early stages, and significant growth is expected in the coming years. Taking a long-term investment strategy can assist you in navigating through short-term market fluctuations and profiting from the industry’s long-term potential.

Conclusion – EV battery stocks

The future of EV stocks to buy looks promising, driven by the rapidly growing electric vehicle industry. As the demand for EVs continues to rise, the demand for high-quality and efficient EV batteries will follow suit. By investing in EV battery stocks, you can position yourself to benefit from this growing market and earn significant returns on your investments.

However, it is crucial to conduct thorough research, evaluate the financial health of companies, and monitor market trends before making any investment decisions. By considering these factors and implementing a well-defined investment strategy, you can unlock the potential of EV battery stocks and make profitable investments in this exciting industry.