Top EV Stocks and Battery Companies: A Comprehensive Guide

More and more investors are turning to electric vehicle (EV) stocks and battery companies to profit from the rising demand for sustainable transportation and clean energy. As the shift towards electric vehicles gains momentum, it’s essential to know the industry’s major players and their growth potential. We have put together a complete guide to assist you in navigating this rapidly developing industry. This guide covers the various materials utilized in batteries, the top manufacturers of raw materials, leading battery companies, and EV stocks, their important attributes, and the crucial factors to keep in mind when investing.

Introduction to the EV Supply Chain

Electric vehicles have revolutionized the automotive industry by offering a sustainable alternative to traditional combustion engines. As the demand for EVs continues to rise, the need for reliable and high-performance batteries has become paramount. EV battery companies play a crucial role in developing and producing advanced lithium-ion batteries that power these vehicles.

If you’re considering investing in electric vehicle (EV) stocks or battery companies, it’s crucial to conduct thorough research and understand the industry’s dynamics. Companies at the forefront of this industry have emerged as innovators in electric vehicle battery technology, offering cutting-edge solutions to address the growing need for eco-friendly transportation. In the following sections, we’ll delve into the top EV battery manufacturers, examining their history, locations, and significant contributions to the industry.

The Role of Materials in EV Battery Production

The production of EV batteries requires various materials, each playing a crucial role in the battery’s performance and efficiency. A typical 60 kwh EV battery has roughly 5kg of cobalt, 6kg of lithium, and around 40 kg of nickel. Here are some critical materials used in EV battery production and their futures price:

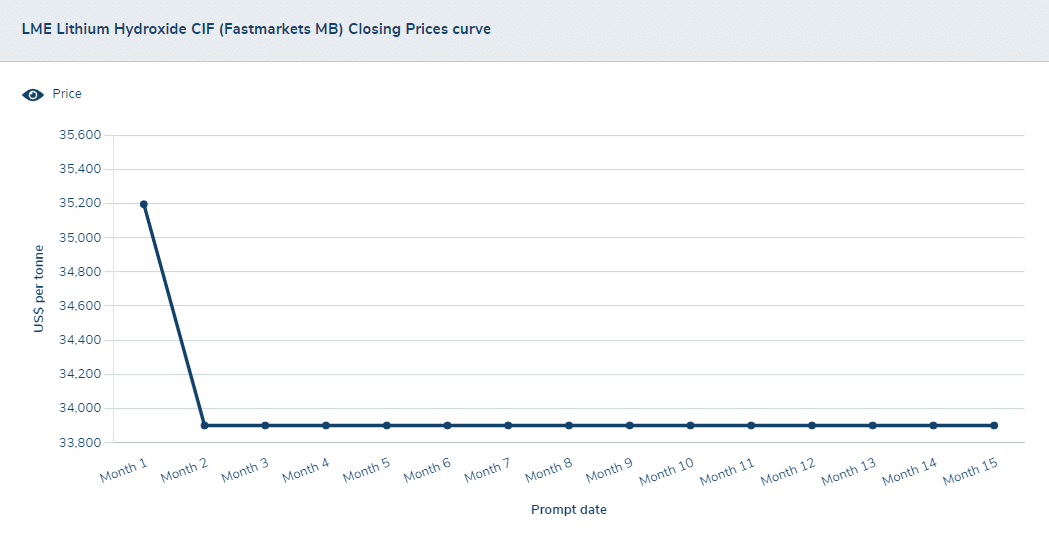

Lithium

Source: The London Metal Exchange

Lithium plays a crucial role in lithium-ion batteries by providing the material for the battery’s cathode. It is a lightweight metal that enables high energy density and efficient energy storage in EV batteries. Chile holds the largest lithium reserves in the world, making it a significant player in the global lithium supply chain.

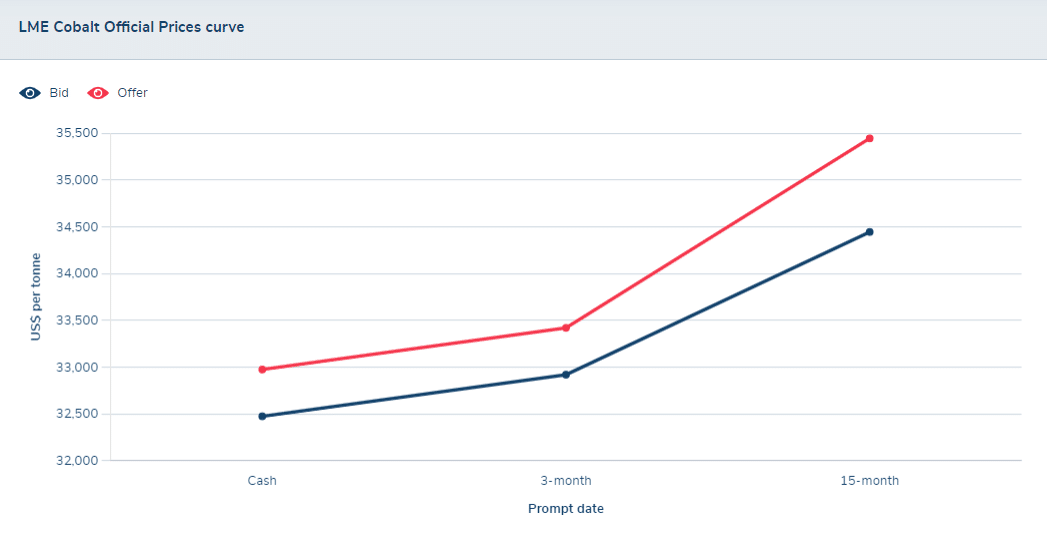

Cobalt

Source: The London Metal Exchange

The cathode of lithium-ion batteries often contains cobalt, which helps enhance the battery’s stability and performance. The Democratic Republic of Congo (DRC) has historically been the largest producer of cobalt, contributing 73% of global output in 2022. Nevertheless, concerns about the ethics of sourcing and environmental impact have arisen due to cobalt mining and production. Hence, there are ongoing initiatives to reduce cobalt usage or explore alternative materials to decrease reliance. Due to these factors, cobalt has limited exposure in trading.

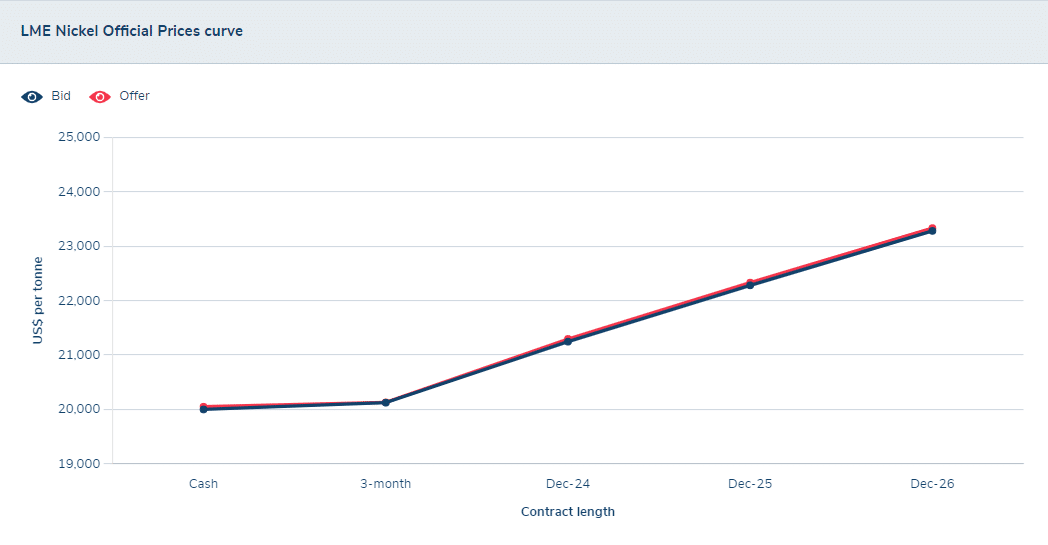

Nickel

Source: The London Metal Exchange

Nickel is another essential material in lithium-ion batteries, particularly in high-energy-density cathodes. Nickel-rich cathode materials offer improved energy density and longer battery life. The demand for nickel is expected to increase as the EV market expands. Most nickel reserves are in Australia, Indonesia, Brazil, and Russia.

Graphite

Graphite plays a crucial role in lithium-ion battery anodes by providing a stable structure for lithium-ion intercalation during charging and discharging cycles. Its high conductivity and stability make it an indispensable material in the production of electric vehicle batteries. Turkey has the largest graphite reserves globally, followed by China and Brazil.

Other Materials

EV battery production requires the use of several materials such as aluminium, copper, manganese, and various chemical additives. These materials play a crucial role in enhancing the battery’s performance, safety, and lifespan.

Raw Materials ETF

Global X Lithium & Battery Tech ETF

Investors can trade the Global X Lithium & Battery Tech ETF on stock exchanges. The fund is focused on companies operating in the lithium and battery technology sector, including those involved in research, development, and manufacturing of battery technology as well as producing, exploring, and developing lithium-related materials. Investing in this ETF enables investors to benefit from the growing demand for lithium-ion batteries, which are essential in electric vehicles, portable electronics, and renewable energy storage systems.

International ETFs

Investors can diversify their portfolios beyond their home country’s borders through International ETFs (Exchange-Traded Funds). These investment funds provide exposure to stocks or securities of companies outside a specific country or region and are designed to track the performance of international markets. International ETFs can focus on a region, country, sector, or industry within the global market.

Chile: The Global Leader in Lithium Reserves

Chile has emerged as the global leader in lithium reserves, positioning itself as a key player in the EV battery supply chain. The country’s vast lithium deposits, particularly in the Atacama Salt Flat, significantly contribute to the global lithium market.

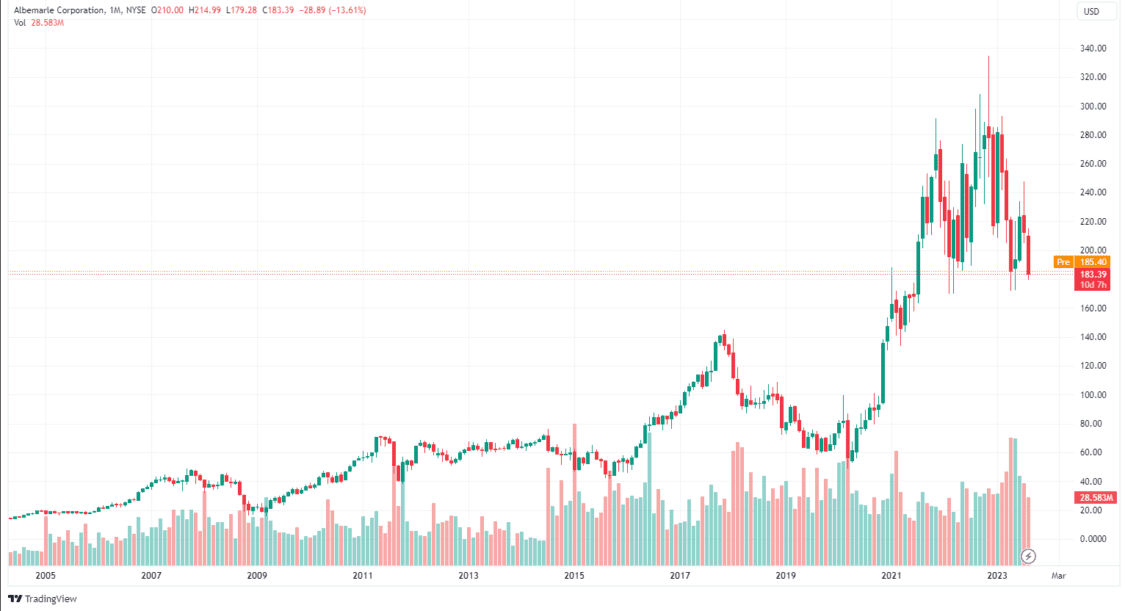

The high lithium concentration in the region’s salt flats and favourable extraction conditions have attracted significant players in the EV battery industry. Companies like Albemarle and SQM have established lithium mining operations in Chile to meet the growing demand for lithium-ion batteries.

Chile’s lithium reserves provide a strategic advantage in producing EV batteries, ensuring a stable supply of this essential material. As the transition to electric vehicles accelerates, Chile’s role in the global EV market is expected to strengthen further.

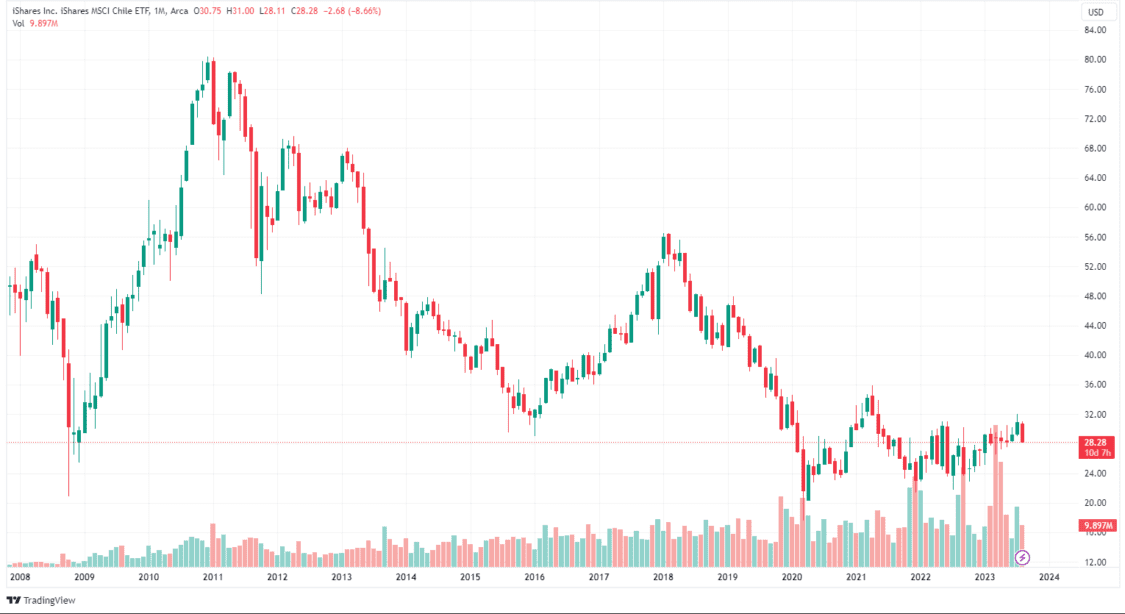

Chile’s President Gabriel Boric said on April 21, 2023; he would nationalize the country’s lithium industry, the world’s second-largest producer of the metal, to boost its economy and protect its environment. We can expat that if such a move occurs, exposure to the Chilean economy can benefit our portfolio.

iShares MSCI Chile ETF

Investing in the iShares MSCI Chile ETF can provide exposure to a broad range of Chilean companies spanning various sectors and potentially benefit from the growth of the Chilean economy. This ETF tracks the performance of the MSCI’s Chile Investable Market Index.

Australia’s Mining Economy

Australia’s mining industry is a major contributor to the country’s economy, accounting for 75% of its exports. This industry also provides a significant number of jobs for the Australian workforce. In fact, the industry’s influence on the country’s standard of living, increasing incomes, and flourishing economy is immense. In the fiscal year 2021-22, Australia’s minerals, metals, and energy commodities exports were valued at $413 billion, accounting for 69% of total export revenue. In the same year, Australian minerals generated an estimated $64 billion in company taxes and royalties, marking a $21 billion increase from the previous year.

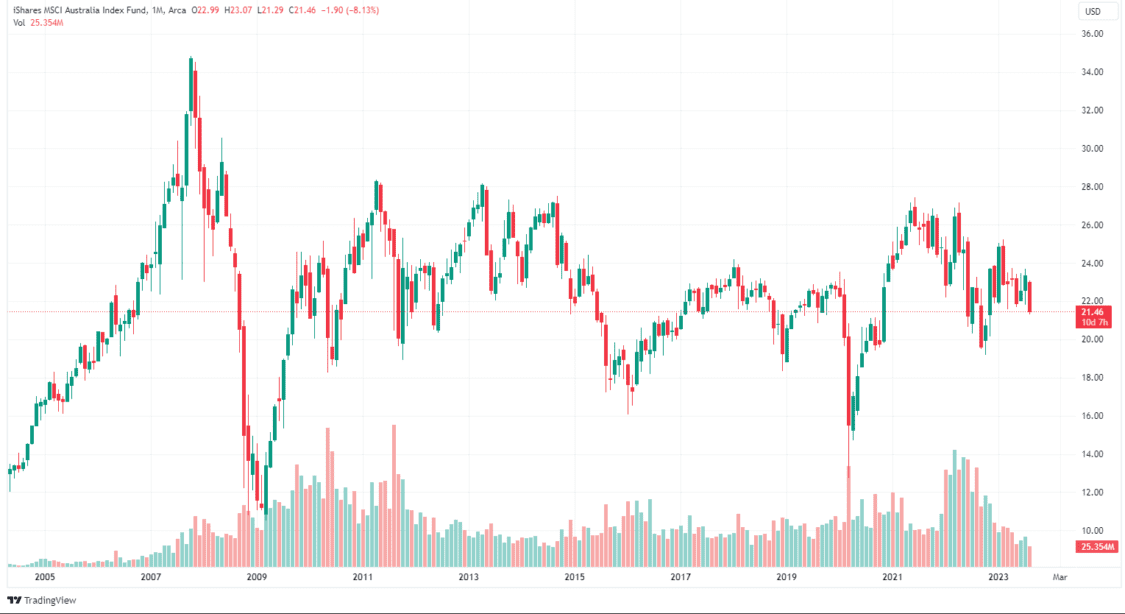

iShares MSCI Australia ETF – exposed to the mining sector

The iShares MSCI Australia ETF tracks the performance of the MSCI’s Australia Investable Market Index, which includes a broad range of Australian companies spanning various sectors. Investing in this ETF can provide exposure to the Australian economy and potentially benefit from its growth.

The ETF may offer exposure to prominent sectors in Australia, such as mining, commodities, finance, and utilities. If you believe these sectors are poised for growth, investing in this ETF could align with your expectations.

Mining companies

There’s also the option to invest directly in the supply chain by investing in mining companies. This way, we can get exposure to the EV market without investing in the production of cars, which can be a volatile investment since the EV market is still evolving.

ALBEMARLE CORP

Albemarle Corporation is a leading specialty chemicals company with a strong presence in sought-after markets all over the world. Their area of expertise is creating advanced specialty chemicals that cater to the distinctive requirements of diverse industries, including petroleum refining, energy storage, consumer electronics, construction, and automotive.

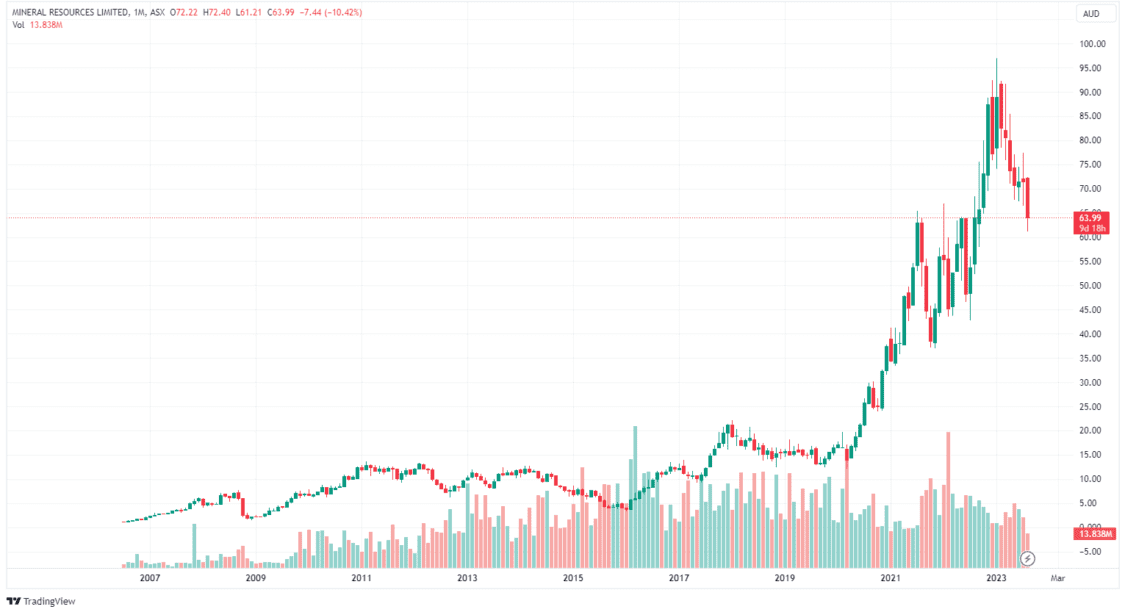

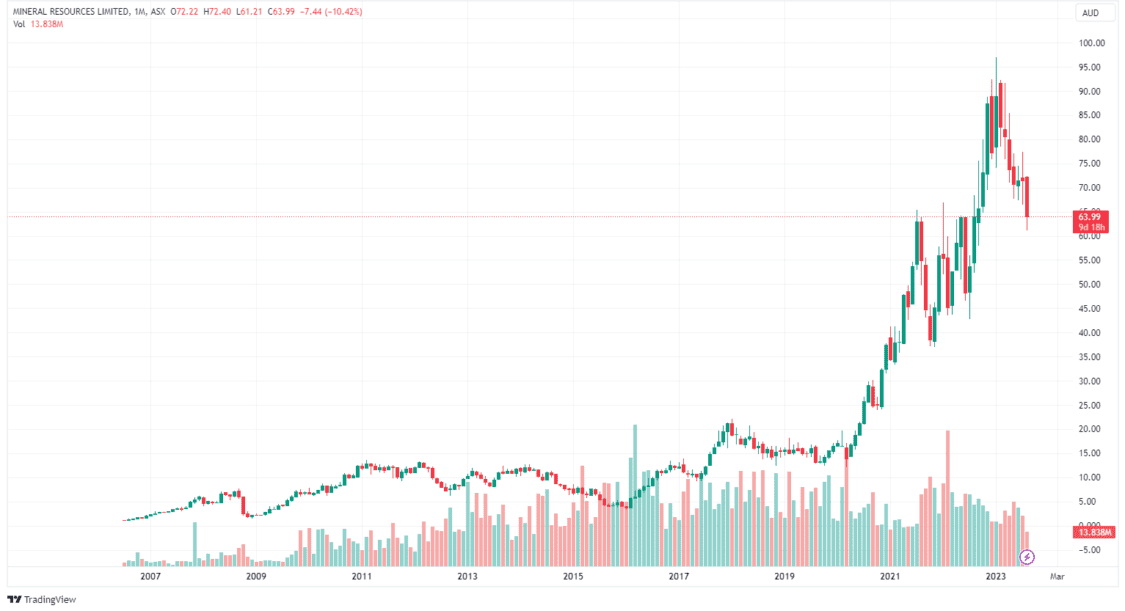

Mineral Resources Ltd

Mineral Resources Limited is a mining services company operating in Australia, China, Singapore, and worldwide. The company operates through five segments: Mining Services and Processing, Iron Ore, Lithium, Other Commodities, and Central. Their services include contract crushing, screening, and processing, specialized mine services such as materials handling, plant and equipment hire and maintenance, tails recovery, and aggregate crushing. Additionally, they offer design, engineering, and construction services for the resource sector.

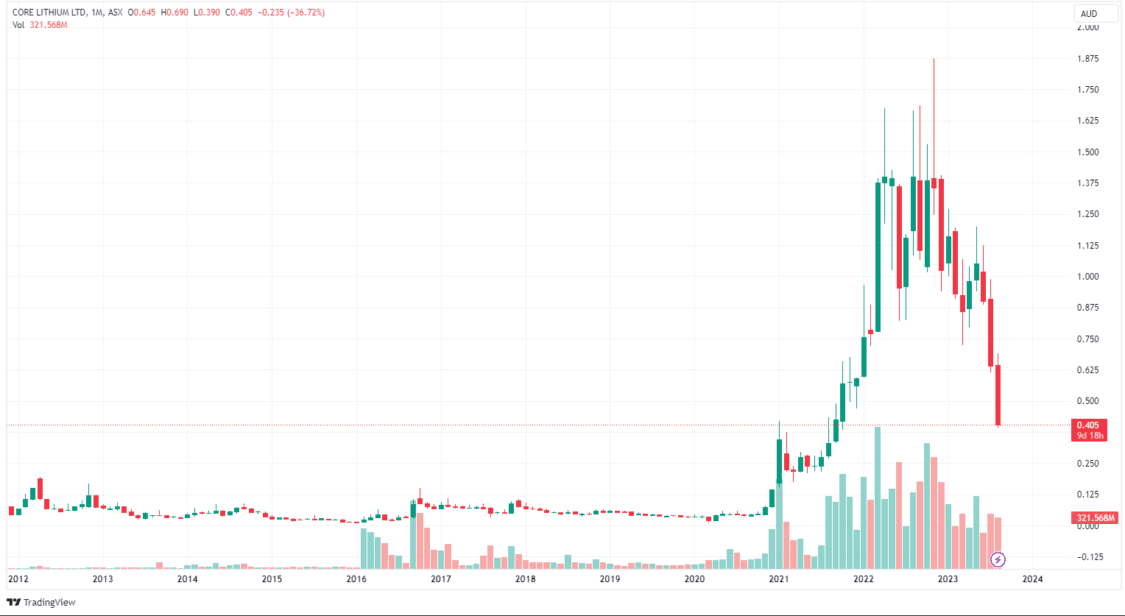

Core Lithium Ltd.

Core Lithium Ltd is a company that focuses on developing lithium and other metal deposits in the Northern Territory and South Australia. The company mainly explores deposits of copper, gold, iron, silver, uranium, lead, and zinc. Its main project is the Finniss Lithium Project, situated south of Darwin Port in the Northern Territory.

BHP Group Ltd

BHP Group Limited is a resources company that operates in various regions worldwide, including Australia, Europe, China, Japan, India, South Korea, North America, South America, and the rest of Asia. The company has three main segments: Copper, Iron Ore, and Coal. Additionally, BHP is involved in mining, smelting, and refining nickel, which BHP expects to play a bigger role in the EV market. They also provide various services such as towing, freight, marketing and trading, marketing support, finance, administrative, and others.

Sociedad Química y Minera de Chile S.A (SQM)

Sociedad Química y Minera de Chile S.A. is a company that specializes in producing plant nutrients, iodine derivatives, lithium derivatives, potassium chloride, and sulfate, as well as industrial chemicals. The company operates in Chile, Latin America, the Caribbean, Europe, North America, Asia, and internationally. The company had the world’s largest market share among lithium chemical-producing companies in 2022, at approximately 20 percent. In 2022, SQM produced 152,500 metric tons of lithium carbonate at its Salar de Atacama operation.

Azure Minerals Ltd.: explore

Azure Minerals Limited is an Australian company that specializes in the exploration of precious and base minerals. Its main focus is on exploring deposits of nickel, cobalt, gold, and copper. The Andover project, located in southeast Karratha, is the company’s flagship project.

Top EV Battery Companies Stocks

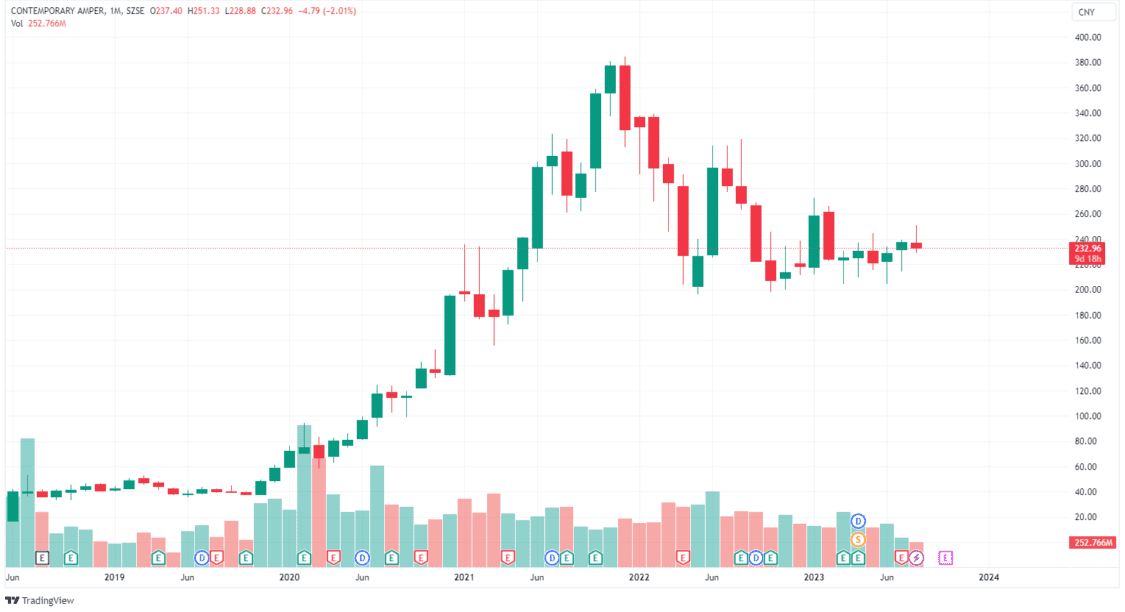

Contemporary Amperex Technology Co., Ltd. (CATL)

Contemporary Amperex Technology is a Chinese company that manufactures lithium-ion batteries for EVs and energy storage systems. They are dedicated to research and development and have become a global leader in EV battery consumption volume. CATL is headquartered in Ningde, Fujian, China, and has research and development centers and production bases all over the world. They offer various solutions for passenger vehicles, commercial applications, energy storage systems, and battery recycling. CATL’s high-power cells are small, lightweight, and have a high energy density, making them ideal for hybrid electric vehicles. Their electric private vehicle solutions are known for fast-charging technology, impressive system energy density, and long driving mileage.

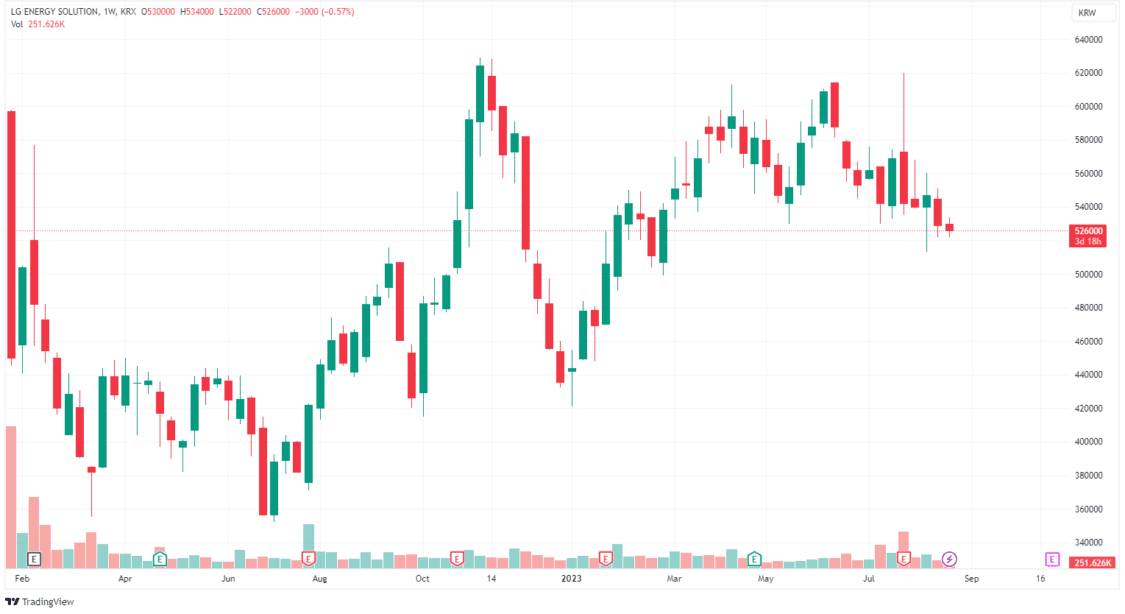

LG Energy Solution Ltd.

LG Energy Solution Ltd., established in 2020, is a leading battery manufacturer that emerged from LG Chem’s battery business. With production bases in South Korea, China, Poland, and the USA, LG Energy Solution offers a diverse portfolio of battery products for various applications.

The company’s expertise lies in advanced automotive, mobility, IT, and energy storage systems (ESS) batteries. LG Energy Solution’s extensive research and development efforts have positioned them as an ideal partner for global automakers seeking reliable, high-performance battery solutions.

With a focus on battery materials and technological advancements, LG Energy Solution aims to contribute to the growth of clean energy and the electric vehicle industry. Their commitment to producing safe, high-quality, and cost-effective batteries has earned them a strong reputation in the market.

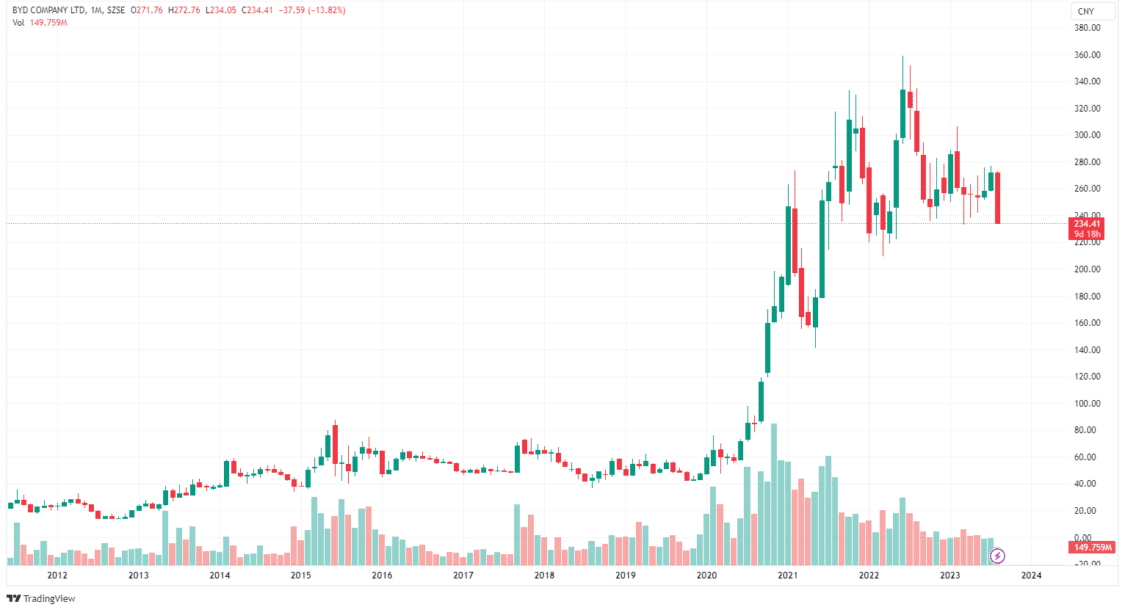

BYD Co. Ltd.

BYD Co., Ltd., short for “Build Your Dreams,” is one of China’s largest privately owned enterprises and a prominent EV and battery industry player. Founded in 1995, BYD has diversified its operations across various sectors, including automotive, electronics, renewable energy, and rail transit.

As a leading producer of rechargeable batteries, including lithium-ion batteries, BYD has established a strong foothold in the EV market. The company owns the entire supply chain layout, from mineral battery cells to battery packs, ensuring quality control and efficient production.

BYD’s batteries suit various applications, including consumer electronics, energy storage, and renewable energy vehicles. Their innovative “Blade Battery” technology addresses battery safety concerns in electric vehicles, offering enhanced safety and increased battery pack space.

Furthermore, BYD’s cobalt-free LFP batteries (lithium iron phosphate batteries) are known for their robust chemistry and universal design, making them suitable for diverse climates and regions worldwide.

Panasonic

Panasonic Corporation, founded in 1918, is a global conglomerate with operations spanning various industries, including appliances, automotive, and industrial solutions. With decades of experience, Panasonic has emerged as a leading supplier of lithium-ion batteries for hybrid, plug-in hybrid, and full-electric vehicles.

Panasonic Automotive, a company division, specializes in designing, engineering, and manufacturing complete battery systems for the automotive industry. Their advanced lithium-ion battery technology offers improved energy density, lower costs, and an extended driving range.

Panasonic Energy of North America (PENA) is another notable subsidiary of Panasonic, producing lithium-ion battery cells for electric vehicles. Their commitment to safety, quality, and cost-effectiveness has positioned them as one of the world’s largest lithium-ion battery cell producers.

Panasonic’s continuous investment in expanding production capacity, such as the facility in De Soto, Kansas, reflects its dedication to supporting the growth of the EV industry in the United States.

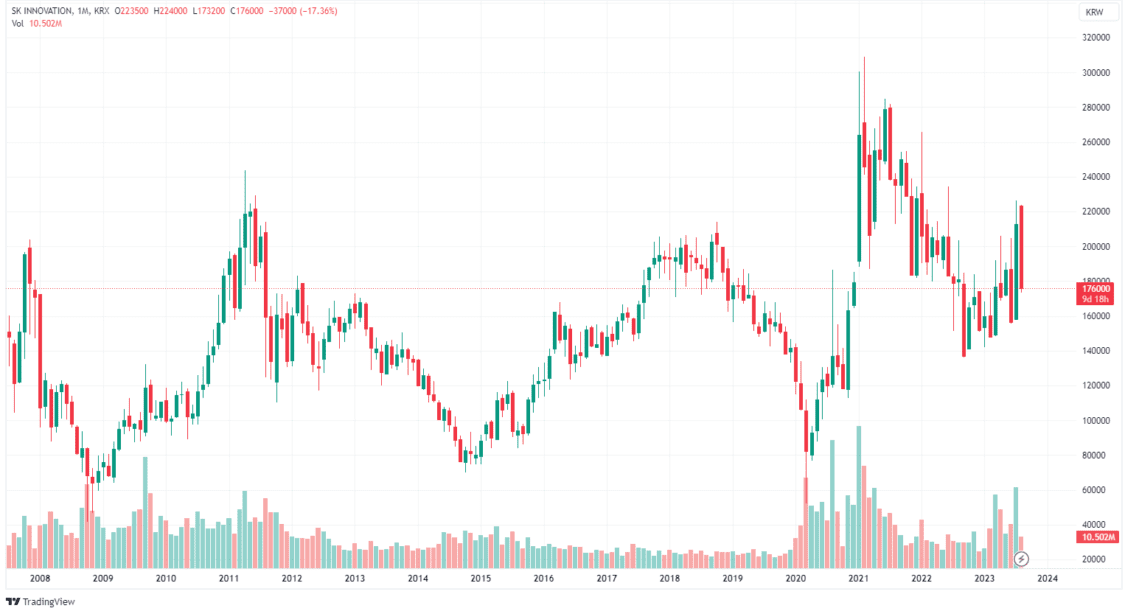

SK Innovation Co., Ltd.

SK Innovation Co., Ltd., an energy and chemical company based in South Korea, is a key player in the EV battery market. The company’s subsidiary, SK On Co., Ltd., focuses on developing high-energy density EV batteries and mass-producing batteries like the NCM66 battery.

SK on Co provides a wide range of batteries for electric, hybrid, and plug-in hybrid EVs. Their high-nickel technology and extensive manufacturing experience enable them to supply batteries that meet the demanding requirements of various vehicle types.

In addition to EV batteries, SK Innovation is actively involved in energy storage systems (ESS) and Battery-as-a-Service (BaaS) solutions. Their comprehensive battery management services cover the entire battery lifecycle, including rentals, recharging, reuse, and recycling.

SK Innovation’s strategic partnerships with major automobile original equipment manufacturers (OEMs) and their proprietary lithium extraction technology further strengthen their position in the EV battery market.

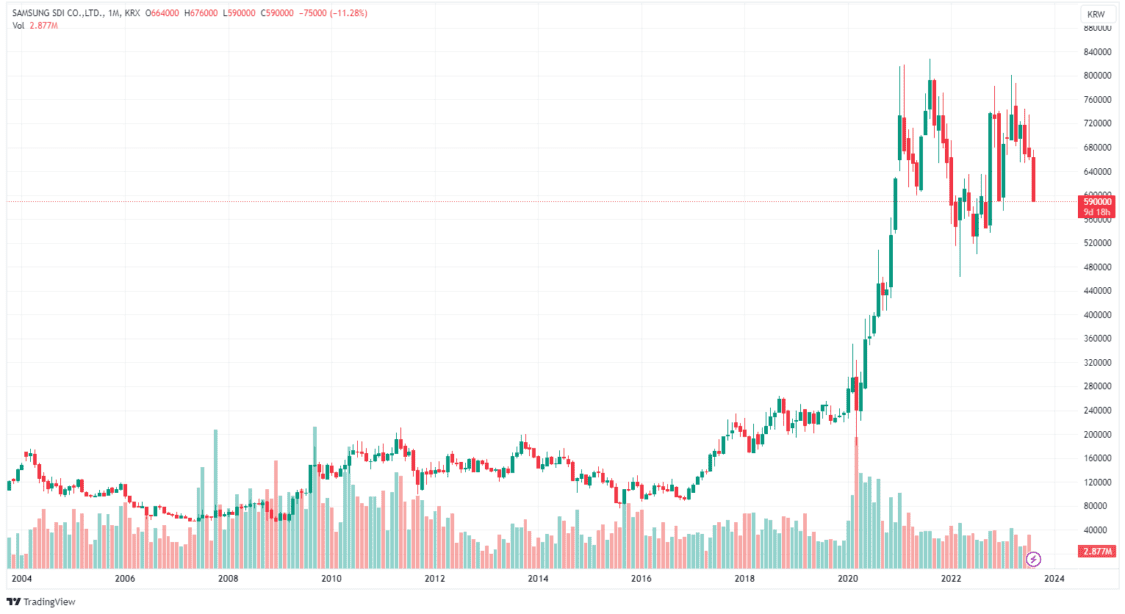

Samsung SDI Co., Ltd.

Samsung SDI Co., Ltd., a South Korean battery and electronic materials manufacturer, has gained significant market share in the small-sized battery market since entering the lithium-ion rechargeable battery business in 2000. The company is known for its advanced battery technologies and diverse product offerings.

Samsung SDI’s lithium-ion battery cells are available in cylindrical, prismatic, and polymer types, offering various advantages such as enhanced product quality, safety, energy efficiency, and longer battery life. These batteries cater to various applications, including consumer electronics, power devices, and transportation.

The company’s small-sized Li-ion battery cells and packs are used in laptops, mobile phones, power banks, vacuum cleaners, e-bikes, and more. With a focus on continuous innovation and sustainability, Samsung SDI plays a crucial role in adopting clean energy solutions.

China Aviation Lithium Battery Co., Ltd. (CALB)

China Aviation Lithium Battery Co., Ltd. (CALB) is a global leader in new energy technology, providing complete product solutions and lifecycle management for various markets. CALB offers a wide range of batteries for passenger vehicles, commercial vehicles, energy storage systems, and special applications.

With a strong presence in the EV market, CALB has contributed to prestigious projects such as the State Grid Kunshan Energy Storage Power Station, the world’s largest grid-side lithium battery storage project.

CALB’s simulation field supports the complete development process, enabling accurate assessments of safety reliability, electrochemistry, structural mechanics, and thermal management. These simulations ensure the quality and performance of their battery products.

The company’s commitment to new energy technology and innovation has cemented its position as a global player in the EV battery market.

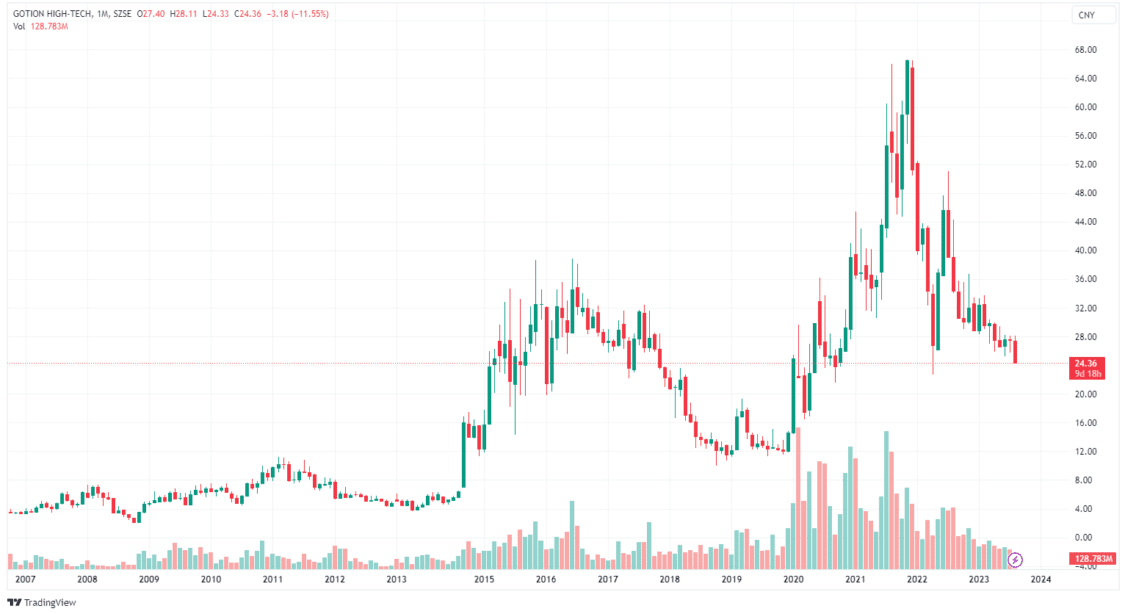

Guoxuan High-tech Power Energy Co., Ltd.

Guoxuan High-tech Power Energy Co., Ltd., based in Hefei, Anhui, China, is a prominent manufacturer of lithium-ion batteries for electric vehicles. The company specializes in providing complete product solutions and lifecycle management for various markets, including passenger vehicles, commercial vehicles, and energy storage systems.

Known for its high-quality batteries, Guoxuan offers a range of solutions for different applications, such as airport service cars, electric forklifts, e-bikes, and sightseeing boats. Their batteries are designed to perform reliably in diverse environments and provide efficient and sustainable energy solutions.

Guoxuan’s commitment to research and development and focus on optimizing battery design and performance have positioned them as a trusted partner in the EV industry.

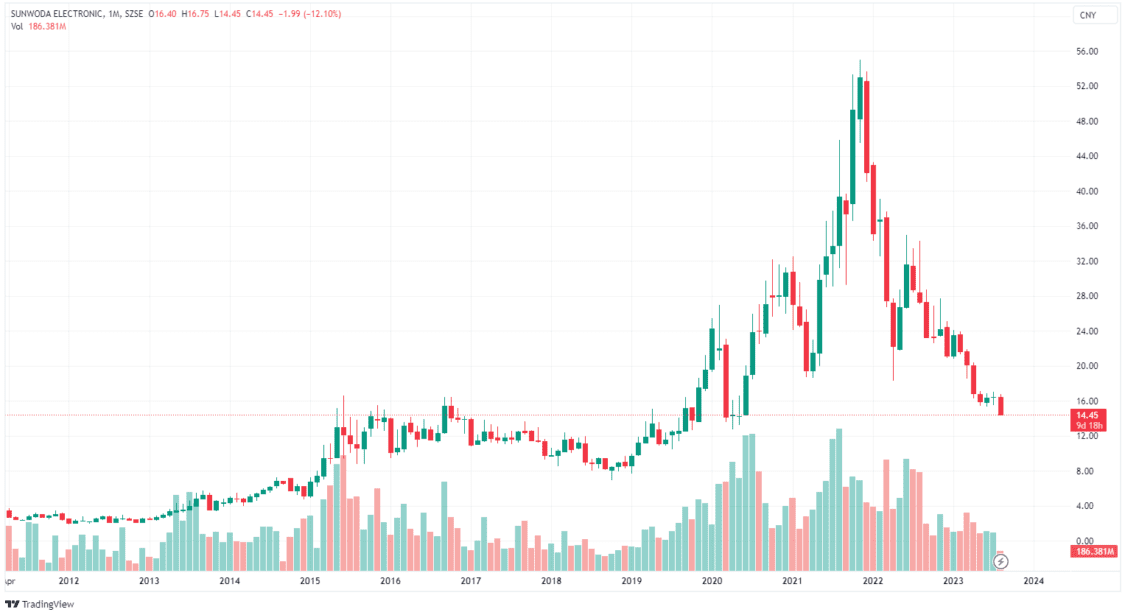

Sunwoda Electronic Co., Ltd.

Sunwoda Electronic Co., Ltd is a prominent manufacturer of lithium-ion batteries and energy storage systems, with its headquarters located in Shenzhen, China.

Sunwoda’s lithium-ion batteries are known for their reliability, high energy density, and long cycle life.

The company’s commitment to quality control and technological innovation has made them a preferred choice for renowned automobile manufacturers and electronic device companies.

With a focus on sustainability, Sunwoda is actively involved in the research and development of advanced battery technologies and energy storage solutions. Their contributions to the EV industry have positioned them as a significant player in the global market.

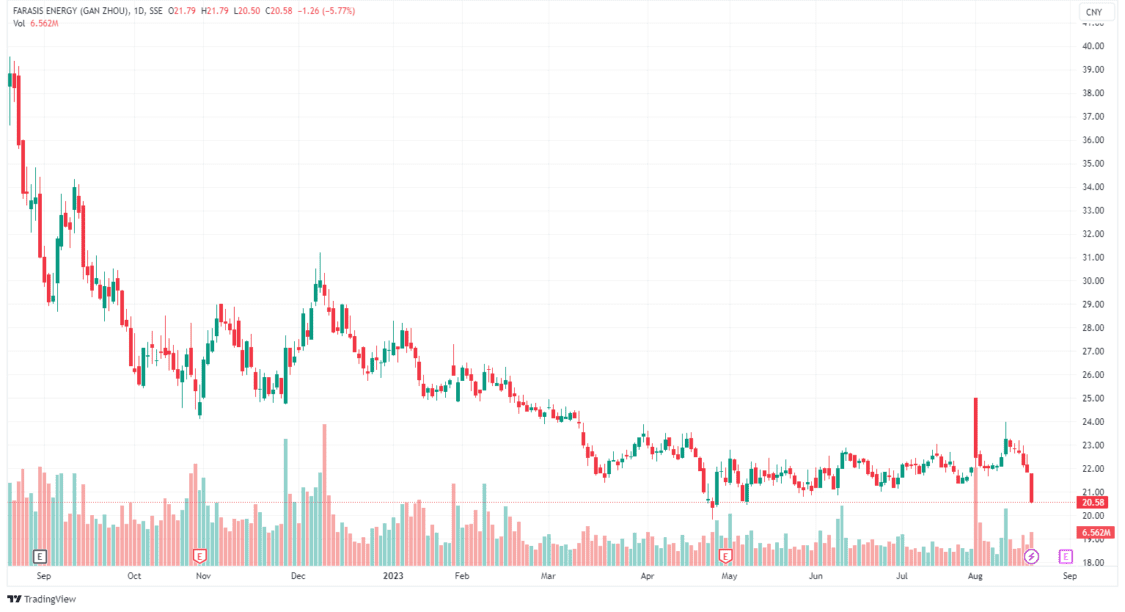

Farasis Energy

Farasis Energy, founded in 2002, is one of the global leaders in developing and manufacturing lithium-ion batteries for electric vehicles. The company offers battery solutions for various applications, including passenger vehicles, commercial vehicles, and energy storage systems.

With a strong emphasis on research and development, Farasis Energy has made significant advancements in battery technology. Their batteries are known for their high energy density, long cycle life, and exceptional safety features.

Farasis Energy’s commitment to sustainability extends beyond its products. The company focuses on implementing environmentally friendly practices throughout manufacturing, to ensure minimal environmental impact.

How to Invest?

Key Considerations for Investing in EV Stocks and Battery Companies

When considering investments in Electric car stocks and battery companies, evaluating various factors that can impact their growth potential is crucial. Here are some key considerations for investors:

Market Demand and Growth Prospects

Evaluate the current and future market demand for electric vehicles and battery technologies. Research industry trends, government incentives, and consumer preferences to gauge the growth prospects of top EV stocks and battery companies.

Technological Advancements and Innovation

Assess the company’s commitment to research and development, technological advancements, and innovation. Companies that invest in cutting-edge technologies and offer differentiated products are more likely to succeed in the evolving EV market.

Manufacturing and Supply Chain Capabilities

When evaluating a company, it’s important to assess their manufacturing capabilities and supply chain efficiency. A company that has strong manufacturing capabilities, easy access to raw materials, and global production bases can have a significant edge in meeting the rising demand for electric vehicle batteries.

Partnerships and Collaborations

Consider the company’s strategic partnerships and collaborations with key stakeholders in the EV ecosystem. Collaborations with automakers, infrastructure providers, and energy companies can enhance market penetration and drive growth.

Financial Performance and Stability

Evaluate the company’s financial performance, revenue growth, and profitability. Strong financials and a stable balance sheet indicate the company’s ability to withstand market fluctuations and invest in future growth opportunities.

Regulatory Environment and Policy Support

Assess the regulatory environment and policy support for the EV industry in different regions. Government incentives, emission regulations, and infrastructure development can significantly impact the growth prospects of the top EV stocks and battery companies.

Competitive Landscape

Analyze the competitive landscape and the company’s positioning within the industry. Consider factors such as market share, technological advancements, customer relationships, and brand reputation to determine the company’s competitive advantage.

Environmental Impact and Sustainability

Assess the company’s commitment to environmental sustainability and responsible business practices. Companies that prioritize environmental impact reduction, recycling initiatives, and ethical sourcing can attract environmentally conscious investors.

Risk Awareness and Responsible Investing

Understand the risks associated with investing in EV stocks and battery companies. Volatility in commodity prices, technological disruptions, regulatory changes, and market competition can impact investment returns. Practice responsible investing by diversifying your investment portfolio and conducting thorough due diligence.

Conclusion: Top EV Stocks and Battery Companies

As the world moves towards sustainable transportation and cleaner energy solutions, the electric vehicle (EV) industry and battery companies are becoming key players in shaping this transformative landscape. This guide provides insight into the complex web of materials, manufacturers, and investments that form the foundation of this dynamic sector.

As the demand for EVs increases, it’s important for investors to be well-informed about the major players, their technological advancements, and their commitment to sustainability. By considering factors such as market growth, technological advancements, manufacturing capabilities, and environmental responsibility, investors can navigate the evolving EV market with greater understanding and make informed decisions that align with their financial and ethical goals. Collaboration between EV manufacturers, battery companies, and investors will be crucial in shaping the future of transportation and energy consumption on a global scale during this era of innovation.